prince william county real estate tax records

In-depth Prince William County VA Property Tax Information. The Building Development activities supported by the fees include.

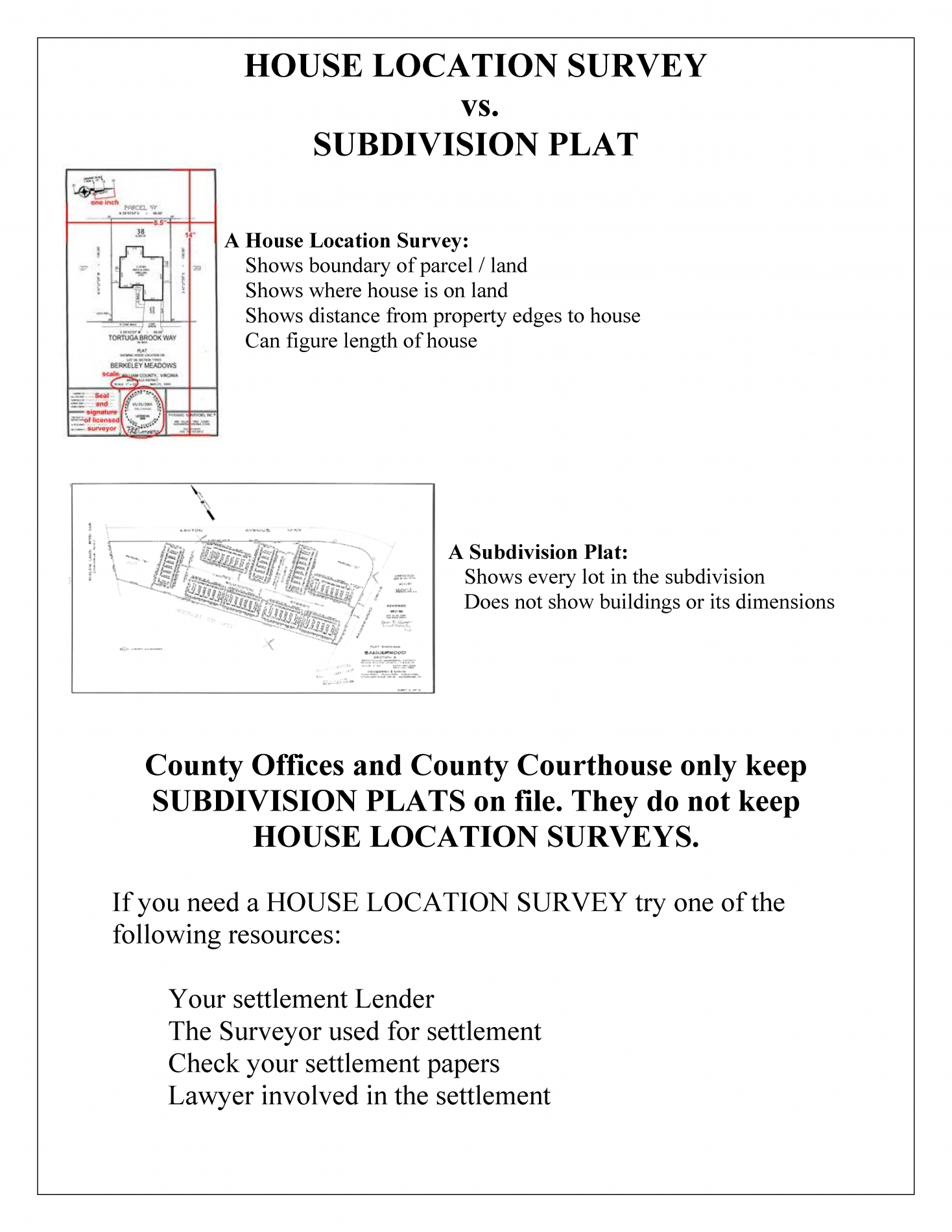

Prince William County has adopted the Building Development Fee Schedule to defray the cost of enforcement of the Virginia Uniform Statewide Building Code.

.jpg)

. Get in-depth information on all of the factors that affect your targeted propertys taxes with a free account. Plan intake plan review permitting and inspections. Access a rundown of its value tax rates and tax exemptions like in the sample below.

See detailed property tax information from the sample report for 2809 Wakewater Way Prince William County VA. Disabled veterans who meet certain criteria may be granted relief from real estate taxes on a home and up to one acre of land it occupies and the solid waste fee. However we can assist you in linking your real estate account.

If you would rather receive this information by email send a request include. If your real estate account does not show on the My Accounts screen it is because real estate account types generally do not automatically link when registering. Please contact us at 703-792-6710 and we will be happy to set this up for you.

Code of Virginia Title 581 Chapter 32 Article 23 Exemption for Disabled Veterans Effective January 1 2021 disabled veterans may qualify for relief on one automobile or pickup truck owned and used.

First Half Of 2020 Real Estate Taxes Due July 15 Prince William Living

Police Basic Recruit School Graduates Today

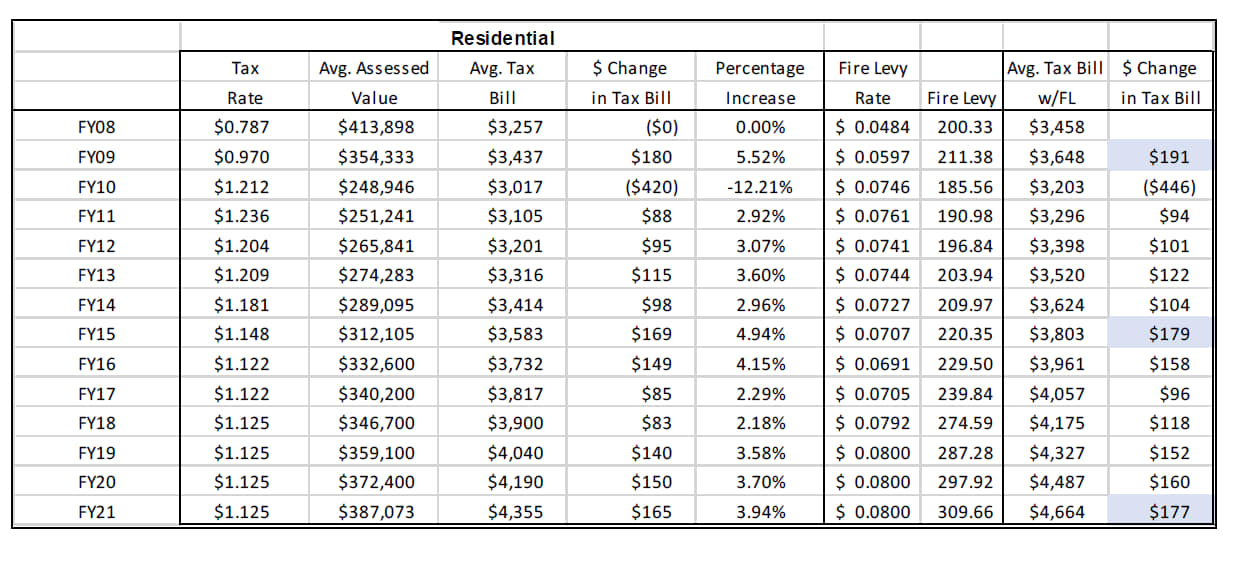

Northern Virginia Residential Property Tax Rates And Due Dates Smart Settlements