ontario ca sales tax calculator

If you have tax rate as a percentage divide that number by 100 to get tax rate as a decimal. Paid Ontario property tax for the year.

91761 Sales Tax Rate Ca Sales Taxes By Zip

See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Ontario CA.

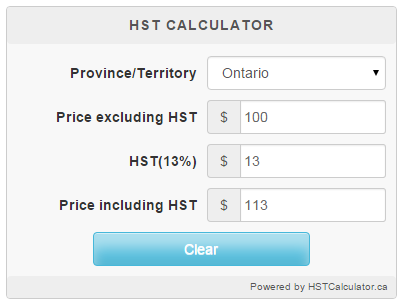

. In 2010 HST was implemented in. How to Calculate Sales Tax. This free online HST calculator allows calculate Harmonized Sales Tax for any Canadian province where Harmonized Sales TaxHST is implemented.

Current 2022 HST rate in Ontario province is 13. Usually the vendor collects the sales tax from the consumer as the consumer makes a. The rate you will charge depends on different factors see.

California State Sales Tax. This is the total of state county and city sales tax rates. Sales tax in Ontario.

Formula for calculating HST in Ontario. Type of supply learn. Ontario is one of the provinces in Canada that charges a Harmonized Sales Tax HST of 13.

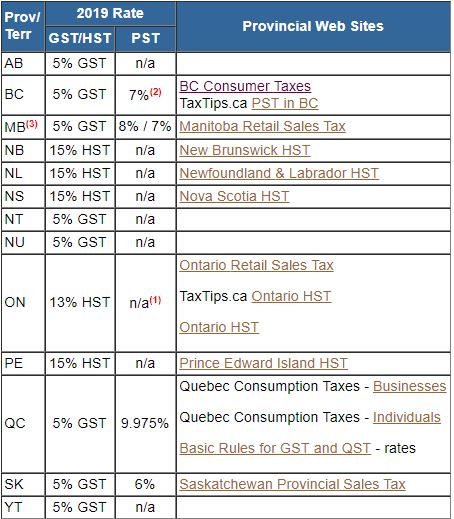

Sales Tax Breakdown For Ontario Canada. 14 rows The following table provides the GST and HST provincial rates since July 1 2010. The OTB is the combined payment of the Ontario energy and property.

Amount without sales tax x HST rate100 Amount of HST in Ontario. Maximum Possible Sales Tax. The HST is applied to most goods and services although there are.

That means that your net pay will be 37957 per year or 3163 per month. Nearby Similar Homes. Amount without sales tax HST amount Total amount with sales taxes.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. 5 Federal part and 8 Provincial Part. Here is an example of how Ontario applies sales tax.

The Ontario California sales tax rate of 775 applies to the following three zip codes. Average Local State Sales Tax. OPEN SUN 11AM TO 4PM.

An alternative sales tax rate of 9 applies in the tax region Montclair which. California has a 6 statewide sales tax rate but also. Ontario ca sales tax calculator Wednesday February 23 2022 Edit.

91758 91761 and 91764. Sales Taxes in Ontario. The current total local sales tax rate in Ontario CA is 7750.

The minimum combined 2022 sales tax rate for Ontario California is. If you make 52000 a year living in the region of Ontario Canada you will be taxed 14043. The December 2020 total local sales tax rate was also 7750.

Integrate Vertex seamlessly to the systems you already use. Multiply the price of your item or service by the tax rate. A sales tax is a consumption tax paid to a government on the sale of certain goods and services.

100 13 HST 113 total. The harmonized sales tax HST which is administered by the Canada Revenue. Harmonized Sales Tax HST in Ontario What is the current 2022 HST rate in Ontario.

The California sales tax rate is currently. Ad Automate Standardize Taxability on Sales and Purchase Transactions. Homes similar to 4251 E Malagon Privado 37 are listed between 580K to 725K at an average of 395 per square foot.

Maximum Local Sales Tax.

7 1 Sales Taxes Mathematics Libretexts

Taxtips Ca 2021 Sales Tax Rates Pst Gst Hst

Ontario Hst Calculator Hstcalculator Ca

Ontario Income Tax Calculator Calculatorscanada Ca

Ontario Sales Tax Hst Calculator 2022 Wowa Ca

Sales Tax Canada Calculator On The App Store

Personal Income Tax Brackets Ontario 2021 Md Tax

Quebec Sales Tax Gst Qst Calculator 2022 Wowa Ca

Ontario Property Tax Rates Calculator Wowa Ca

Bc Sales Tax Gst Pst Calculator 2022 Wowa Ca

Taxtips Ca 2019 Sales Tax Rates For Pst Gst And Hst In Each Province

What Determines Whether I Pay 5 Tax Or 13 Tax On Food In Ontario Quora

Ontario Income Tax Calculator Wowa Ca

Income Tax Calculator Calculatorscanada Ca

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download